Plan Information

You will find more detailed information and resources related to each of the City’s benefit offerings*, listed below in alphabetical order, such as plan booklets, summary of benefits, certificate booklets, provider contact information, website links, and more. If you are looking for any related benefit forms, they can be found on our main Benefits web page.

If you have any questions about your City of Tacoma benefit plans, please contact the Human Resources Benefits Office.

*Note: Plan participation may vary by union representation. Review applicable collective bargaining agreements for more information on the above benefit programs and any additional benefit offerings available through City employment and your union affiliation.

Deferred Compensation 457(b) Plan

In addition to a mandatory employer and employee paid retirement pension plan, the City of Tacoma provides its employees with a voluntary deferred compensation program, which allows employees to supplement their normal retirement income with a savings plan that is authorized under Section 457 of the IRS Code. The value of the account is based on contributions made and the investment performance over time.

You will find useful information that applies to the Deferred Compensation plan below under General Plan Information, such as features of a Deferred Compensation plan and detailed enrollment, deferral, and coverage information. Additionally, you can access detailed contact information and services provided by our two plan administrators MissionSquare Retirement and Nationwide, and access information related to the City of Tacoma’s Deferred Compensation Committee that oversees this plan offering.

-

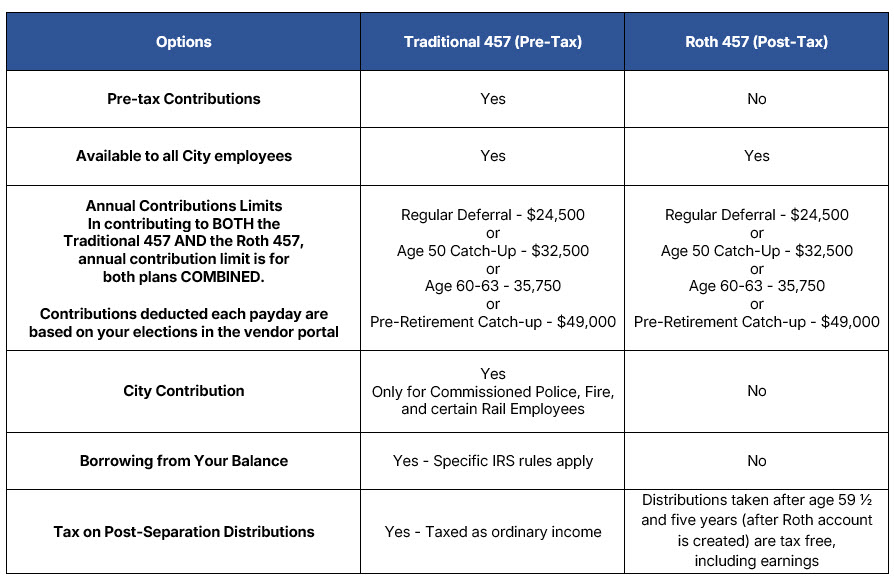

Features of a Deferred Compensation 457(b) Plan:

Features of a Deferred Compensation 457(b) Plan:A deferred compensation plan can help bridge the gap between what is available with the City’s pension plan and Social Security, and how much is needed in retirement. Employees can choose to make pre-tax contributions that reduce their taxable income for the year and in turn, those contributions and all associated earnings are not subject to federal tax until withdrawn. There is also an option to make after-tax Roth contributions, which allow for potentially tax-free earnings. Employees may choose to contribute to both the Traditional and Roth plans, however, the annual contribution limit for the Traditional and Roth combined must adhere to the IRS annual maximum limits listed below.

Please consult your personal financial advisor or the Deferred Compensation representative from MissionSquare Retirement or Nationwide (Local 31 Only) for more information on the tax implications of each plan.

2026 Deferred Compensation Limits

2026 Employee Contribution Limits

- Employee Contribution Limits (Except Rail, and Commissioned Police and Fire)

- Employee Contribution Limits (Police Local 6 Only)

- Employee Contribution Limits (Police Local 26 Only)

- Employee Contribution Limits (Fire Local 31 Only)

- Employee Contribution Limits (PPSMA Only)

- Employee Contribution Limits (Rail Only)

Plan Document

Enrolling and Making Deferral Changes

Deferral increases, decreases, as well as new enrollments must be made using your plan administrator’s portal (links to each vendor and instructions are provided in the MissionSquare Retirement or Nationwide Plan Administrator accordions below). These changes will take effect immediately. All changes for a given pay date, must be made no later than midnight the Sunday before the upcoming pay date.

Investing

Participants are able to directly control how their account is invested via the plan administrator’s portal (links to each vendor and instructions are provided in the MissionSquare Retirement or Nationwide Plan Administrator accordions below). Participants may choose from a wide range of options. Plan representatives and Certified Financial Planners are available from our plan administrators to assist with investment decisions. Please note that City of Tacoma Benefits staff are unable to provide investment advice.

Beneficiaries

Participants designate a beneficiary, or beneficiaries, through the plan administrator’s portal (links to each vendor and instructions are provided on the MissionSquare Retirement or Nationwide plan administrator accordions below). Designating beneficiaries can help ensure assets are paid out according to the plan participant’s wishes, avoids the potential costs and delays of probate, and allows non-spouse beneficiaries to receive additional tax benefits.

Withdrawals

Participants can make withdrawals from their account when they leave employment with the City and have the option to receive payments as needed or request scheduled automatic payments. Participants maintain control over their investments and continue to benefit from tax deferral and the City’s low fees even after separation from employment.

During employment, subject to the City’s plan and IRS rules, you may also be able to make withdrawals after age 70½ or due to an unforeseeable emergency. A loan option for the Traditional Plan funds you’ve contributed is also available through the vendor portal and has no age restrictions.

Withdrawals are generally taxable but, unlike other retirement accounts, the 10% penalty tax does not apply to distributions prior to age 59½ (the penalty tax may apply to distributions of assets that were transferred to the 457 plan from other types of retirement accounts).

If you have any questions, please contact the Benefits Office or the account representative listed on the applicable plan administrator sections below.

-

You will find useful information that applies to the deferred compensation plan and MissionSquare Retirement’s service offerings below, such as contact information, options to meet with a MissionSquare representative virtually or onsite, enrollment instructions, investing and financial planning service options, loan guidelines, additional resources, and other disclosures.

You will find useful information that applies to the deferred compensation plan and MissionSquare Retirement’s service offerings below, such as contact information, options to meet with a MissionSquare representative virtually or onsite, enrollment instructions, investing and financial planning service options, loan guidelines, additional resources, and other disclosures.For quick access to other useful information on the City of Tacoma’s Deferred Compensation plan, such as plan features, contribution limits, detailed plan information, please see the General Information section above.

Contact Information

800-669-7400

msqplanservices.org/myplan/302010View instructions for online enrollment and changes for MissionSquare.

Representative

Jeff Spindle

1-866-328-4664 Email: jspindle@missionsq.orgFinancial Planning

Certified Financial Planner Resources

MissionSquare Rev Up Your RetirementLoans

MissionSquare Loan Guidelines and ProceduresVendor Information

MissionSquare Get to Know Your 457Mobile App

-

Welcome to the Nationwide plan administrator information section.

Welcome to the Nationwide plan administrator information section.You will find useful information that applies to the deferred compensation plan and Nationwide’s service offerings below, such as contact information, options to meet with a Nationwide representative virtually or onsite, enrollment instructions, investing and financial planning service options, loan guidelines, additional resources, and other disclosures.

For quick access to other useful information on the City of Tacoma’s Deferred Compensation plan such as plan features, contribution limits, detailed plan information, please see the General Information section above.

Note: Nationwide is only available to Local 31 members.Contact Information

877-677-3678

nrsforu.com/rsc-web-preauth/index.htmlView instructions for online enrollment and changes for Local 31 only.

Representative

Mike Ferguson

509-385-7825 email: m.ferguson@nationwide.comWorkplace Visits

Contact Representative for InformationFinancial Planning

Certified Financial Planner Resources

Loans

Nationwide Loan Guidelines and ProceduresVendor Information

Paperless Account Management

Mobile App Information

-

The Plan intends to foster an investment environment that encourages and facilitates participant efforts to supplement other sources of retirement income. The primary investment objective of the Plan is to present participants with a range of investment options, which give participants an opportunity to increase the value of their account in a manner consistent with varying levels of participant risk/reward tolerances and investment decision making skills. While the Plan cannot meet all plan participant investment preferences and attitudes, the Plan attempts to provide investment options for participants at various levels of investment sophistication and with varying requirements for risk and return.

The Plan intends to foster an investment environment that encourages and facilitates participant efforts to supplement other sources of retirement income. The primary investment objective of the Plan is to present participants with a range of investment options, which give participants an opportunity to increase the value of their account in a manner consistent with varying levels of participant risk/reward tolerances and investment decision making skills. While the Plan cannot meet all plan participant investment preferences and attitudes, the Plan attempts to provide investment options for participants at various levels of investment sophistication and with varying requirements for risk and return.Deferred Compensation Plan Governing Documents

Deferred Compensation Committee Meetings

Annual Deferred Compensation 2026 Meeting Schedule

Month

Minutes

AgendaDecember 2025 Pending Agenda November 2025

Non-Regular MeetingMinutes Agenda October 2025

Non-Regular MeetingMinutes Agenda August 2025 Minutes Agenda May 2025 Minutes Agenda February 2025 Minutes Agenda December 2024 Minutes Agenda August 2024 Minutes Agenda May 2024 Minutes Agenda February 2024 Minutes Agenda December 2023 Minutes Agenda August 2023 Minutes Agenda May 2023 Minutes Agenda February 2023 Minutes Agenda December 2022 Minutes Agenda

Dental Insurance Plans

The City of Tacoma currently provides two dental plan options. Employees have the choice at the time of hire or during open enrollment periods to enroll in the Willamette Dental DHMO Plan and the Delta Dental of Washington DPPO Plan.

-

Here you will find useful information that applies to the DPPO plan offered through Delta Dental of Washington, such as features of a DPPO plan, contact information, detailed coverage information, and other disclosures.

Features of a DPPO Plan

- DPPO stands for “Dental Preferred Provider Organization”

- Participants have the ability to see providers in or out of network, but experience lower out-of-pocket costs by using network providers

- No referrals are required to see a specialist

Contact Information

800-554-1907

deltadentalwa.comPlan Information

Other Resources

Other Information/Disclosures

Mobile App

-

Here you will find useful information that applies to the DHMO plan offered through Willamette Dental below, such as features of a DHMO plan, contact information, detailed coverage information, and other disclosures.

Here you will find useful information that applies to the DHMO plan offered through Willamette Dental below, such as features of a DHMO plan, contact information, detailed coverage information, and other disclosures.Features of a DHMO Plan

- DHMO stands for “Dental Health Maintenance Organization”

- Participants may only visit dentists that are within the DHMO network

Contact Information

855-433-6825

willamettedental.comPlan Information

Other Information/Disclosures

The City of Tacoma currently has two medical carriers, Kaiser Permanente and Regence BlueShield. Employees have the choice at the time of hire or during open enrollment periods to enroll in the Kaiser Permanente HMO Plan or the Regence BlueShield PPO or Regence BlueShield High Deductible Plans. Eligible retirees have access to the Regence BlueShield plan options.

Vision Insurance Plans

The City of Tacoma currently has two vision carriers, Vision Service Plan (VSP) and Kaiser Permanente. Employees have the choice at the time of hire or during open enrollment periods to enroll in medical plan coverage which determines which vision plan they will be enrolled in. For employees who select Regence BlueShield as their medical plan, the City of Tacoma provides vision benefits through the Vision Service Plan (VSP). For those employees who choose Kaiser Permanente, vision benefits are offered through the Kaiser medical plan. You will find useful information that applies to the vision plans below, such as contact information, detailed coverage information, options to access care, additional resources, and other disclosures.

-

Contact Information

Contact InformationPlan Information

- Vision Service Plan (VSP) Summary 2025

- Vision Service Plan (VSP) Summary 2026

- Keeping Your Eyes Healthy

- Vision Service Plan Certificate

Options to Access Care

Additional Resources

Other Information/Disclosures

Mobile App

-

Contact Information

Contact Information800-664-9225

https://wa-eyecare.kaiserpermanente.orgPlan Information

Other Information/Disclosures

Mobile App

Other Benefit Plans

-

Plan Information

- City-Paid-Long Term Disability Summary

- Employee-Paid Voluntary Long Term Disability Buy Up Summary

- Employee-Paid Voluntary Short Term Disability

- Long-Term Disability Certificate Booklet

- Short-Term Disability Certificate Booklet

Enrollment for Voluntary Coverage

Contact the Benefits Office to request the needed application forms to apply for supplemental voluntary disability insurance coverage with The Standard insurance carrier. This process may require medical underwriting that can include completing, at no cost, a physical exam and/or providing a blood sample.

Other Information/Disclosures

-

The Employee Assistance Program (EAP) provides no-cost, convenient, and confidential assessment and referral consultation and work life resources to help manage life’s challenges. This includes coaching and problem services with a licensed behavioral health provider as well as work life resources such as legal, financial, and identity theft consultations, childcare and eldercare referrals, and home ownership services and discounts. The EAP provides access 24 hours a day, seven days per week. You will find useful information that applies to the EAP plan offered through First Choice Health below, such as contact information, detailed coverage information, options to access care, and other disclosures.

The Employee Assistance Program (EAP) provides no-cost, convenient, and confidential assessment and referral consultation and work life resources to help manage life’s challenges. This includes coaching and problem services with a licensed behavioral health provider as well as work life resources such as legal, financial, and identity theft consultations, childcare and eldercare referrals, and home ownership services and discounts. The EAP provides access 24 hours a day, seven days per week. You will find useful information that applies to the EAP plan offered through First Choice Health below, such as contact information, detailed coverage information, options to access care, and other disclosures.Contact Information

800-777-4114

fchn.com/Members/EAP (Employee Login: cityoftacoma)Plan Information

Options to Access Care

Other Information/Disclosures

EAP Newsletters

Month Employees Supervisors January 2026 Employee Newsletter Supervisor Newsletter December 2025 Employee Newsletter Supervisor Newsletter November 2025 Employee Newsletter Supervisor Newsletter October 2025 Employee Newsletter Supervisor Newsletter September 2025 Employee Newsletter Supervisor Newsletter August 2025 Employee Newsletter Supervisor Newsletter July 2025 Employee Newsletter Supervisor Newsletter June 2025 Employee Newsletter Supervisor Newsletter May 2025 Employee Newsletter Supervisor Newsletter April 2025 Employee Newsletter Supervisor Newsletter March 2025 Employee Newsletter Supervisor Newsletter February 2025 Employee Newsletter Supervisor Newsletter January 2025 Employee Newsletter Supervisor Newsletter -

The City of Tacoma provides an IRS Section 125 Flexible Benefits Spending Plan, which allows for employees to save money on their health and dependent care expenses with pre-tax dollars. Under the Section 125 Flexible Benefits Spending Plan, there are two plan components: Health Flexible Spending Account (Health) that is for out-of-pocket health care expenses and a Dependent Care Flexible Spending Account (Dependent Care FSA) that is for out-of-pocket day care expenses for a child or adult dependent that cannot care for themselves. You will find useful information that applies to the FSA plan below, such as detailed coverage information, contact information options to access care, and other disclosures.

Flexible Spending Account (FSA) Administrator

Trusted Plan Services Corporation (TPSC)

253-564-5611 x210 or 800-426-9786 x210

https://www.tpscbenefits.com

Portal LoginPlan Information

Additional Resources

- Health Care FSA Spending Overview

- Health Care FSA Spending Fact Sheet

- Dependent Care FSA Fact Sheet

- FSA Expense Substantiation Requirements

- FSA Orthodontia Expense Procedures

- FSA Portal Quick Reference – Contact the Benefits Office

- FSA Portal User Guide – Contact the Benefits Office

- Secure Submission Guide

- Health Flexible Spending EzPay App & Wallet

Other Information/Disclosures

Mobile App

-

The City of Tacoma provides to eligible employees an employer-paid health reimbursement account (HRA) benefit post-retirement. This is an IRS defined “account-based” group health plan and it is often referred to as “VEBA” because its assets are held in a tax-exempt, voluntary employees’ beneficiary association (VEBA) trust that is authorized under Section 501(c)(9) of the IRS Code. The City of Tacoma provides this benefit by depositing Sick Leave and Personal Time Off (PTO) severance payments tax-free into the account at the time of retirement or death.

** You will find useful information that applies to the HRA VEBA plan below, such as features of an HRA VEBA plan, detailed coverage information, contact information, and other disclosures.

HRA Veba Administrator

HRA VEBA

888-659-8828

hraveba.orgFeatures of an HRA VEBA

An HRA VEBA account is a special type of health plan arrangement that is similar to a Health Savings Account (HSA) or Flexible Spending Account (FSA) by allowing individuals to use the funds to pay for or reimburse themselves for out-of-pocket health expenses and premiums. But unlike some of the features with these other type of health arrangements you can invest the funds, there are no contribution limits, there is no annual use-it-or lose it rule, the funds can be passed on to a beneficiary at time of death, and the money is deposited, invested, and withdrawn tax-free allowing the money to go much further.

Eligibility

Non-represented employees* and certain represented employees** in which the collective bargaining agreement (CBA) provides for the benefit. Please refer to Tacoma Municipal Code Section 1.12.229, and/or the applicable collective bargaining agreement for specific details.

*The Tacoma Municipal Code 1.12.229 provides this contribution is in effect each year unless at least 20 percent of non-represented employees who are eligible to retire in the next calendar year request a vote be conducted. If the 20 percent threshold is met, eligible employees will be notified of a vote to be conducted. The results of the vote will determine whether to suspend the VEBA deposit for the next calendar year only, which will be determined by a majority of the returned ballots. If the 20 percent threshold is not met, no vote will be conducted, and the VEBA deposit will be in place for the next calendar year.

City of Tacoma Non-Represented Employee Annual VEBA Process Timeline

**Some Employee Groups/CBAs allow for contributions to an HRA VEBA prior to retirement. For these groups, if an employee wishes to sign for up a high-deductible health plan (HDHP) with a Health Savings Account (HSA), they will be required to complete a Limited Purpose Election form with HRA VEBA to put their VEBA account in limited coverage (e.g., dental and vision benefits only). The IRS requires this action take place in order for an individual to be eligible to make or receive contributions to an HSA. Your limited-purpose coverage election will remain in force until you make a change. You can make one limited-purpose coverage election change per calendar year. Please contact the Benefits Office for the Limited Purpose Election form.

How is the HRA VEBA Funded?

- Non-represented employees: 50% Personal Time Off (PTO) / 25% Sick Leave in a year the VEBA benefit is in place*

- Represented Employees varies by CBA **

Types of Covered Expenses

Funds deposited into a VEBA can be used for qualified out-of-pocket expenses including co-pays, coinsurance, deductibles, over-the-counter health care expenses, retiree insurance premiums (including Medicare Part B and Part D and Medicare supplement plans), TRICARE premiums and expenses, and tax-qualified long-term care insurance premiums (subject to annual IRS limits). Refer to IRS Publication 502 Medical and Dental Expenses and Section 213(d) of the Internal Revenue Code (IRC) for more details.

Note: HRA VEBA can reimburse qualified healthcare expenses incurred by the participant, spouse, and qualified dependents.

Beneficiaries

If you pass away, your HRA can transfer to your surviving spouse, children, designated beneficiaries, or other eligible survivors. You can designate your beneficiaries once your account is funded.

Additional Resources

- List of City of Tacoma VEBA Eligible Groups

- Information on Separation vs Separation/Retirement

- VEBA Presentation (August 2024)

- VEBA Plan Brochure

- Health Reimbursement Account (HRA) Basics

- Eligible Medical Care Expenses

- VEBA Investment Fund Overview

Other Information/Disclosures

-

The City of Tacoma provides two forms of employer-paid Life Insurance benefits, Basic Life and Accidental Death and Dismemberment (AD&D) in the event of an employee’s death. Additionally, the City offers access to voluntary employee-paid Supplemental Life and AD&D insurance benefits at group rates, for employees and their family members. You will find useful information that applies to the Life Insurance plans offered through The Standard Insurance below, such a plan information, enrollment procedures for voluntary coverage, additional resources and benefit offerings, and other disclosures.

The City of Tacoma provides two forms of employer-paid Life Insurance benefits, Basic Life and Accidental Death and Dismemberment (AD&D) in the event of an employee’s death. Additionally, the City offers access to voluntary employee-paid Supplemental Life and AD&D insurance benefits at group rates, for employees and their family members. You will find useful information that applies to the Life Insurance plans offered through The Standard Insurance below, such a plan information, enrollment procedures for voluntary coverage, additional resources and benefit offerings, and other disclosures.Plan Information

- Basic Life Insurance and AD&D Summary

- Employee Paid Additional Life Insurance Summary

- Life Insurance Certificate Booklet

Enrollment for Voluntary Coverage

Contact the Benefits Office to request the needed application forms to apply for supplemental voluntary life insurance coverage with The Standard insurance carrier. This process may require medical underwriting that can include completing at no cost, a physical exam and/or providing a blood sample.

Additional Resources

Other Information/Disclosures

-

The health and happiness of our employees is crucial to the success of our organization. We cannot have one without the other. To help promote good health and well-being, we launched the Tacoma Employee Wellness (TEW) Program in 2015.

The health and happiness of our employees is crucial to the success of our organization. We cannot have one without the other. To help promote good health and well-being, we launched the Tacoma Employee Wellness (TEW) Program in 2015.Whether you’re already living a healthy lifestyle or are just beginning to make some changes, the TEW Program can help empower you to reach your health and wellness goals. As a bonus, you can earn incentives such as reduced health insurance premium contributions.

To learn more about our TEW Program, visit the Wellness website or contact the City’s Wellness Coordinator, Shannon Carmody at 253-591-5200 or wellness@tacoma.gov.