Business Financing Options

At the City of Tacoma, we understand that financing is crucial for businesses to thrive and grow. We offer various options tailored to meet the diverse needs of entrepreneurs in our community.

Whether you’re looking for funding to start a business in Tacoma want to expand operations, purchase equipment, or increase inventory for your current business – we’re here to help. Small business loans are available for qualified applicants through the various programs below.

Ways to Finance Your Business

-

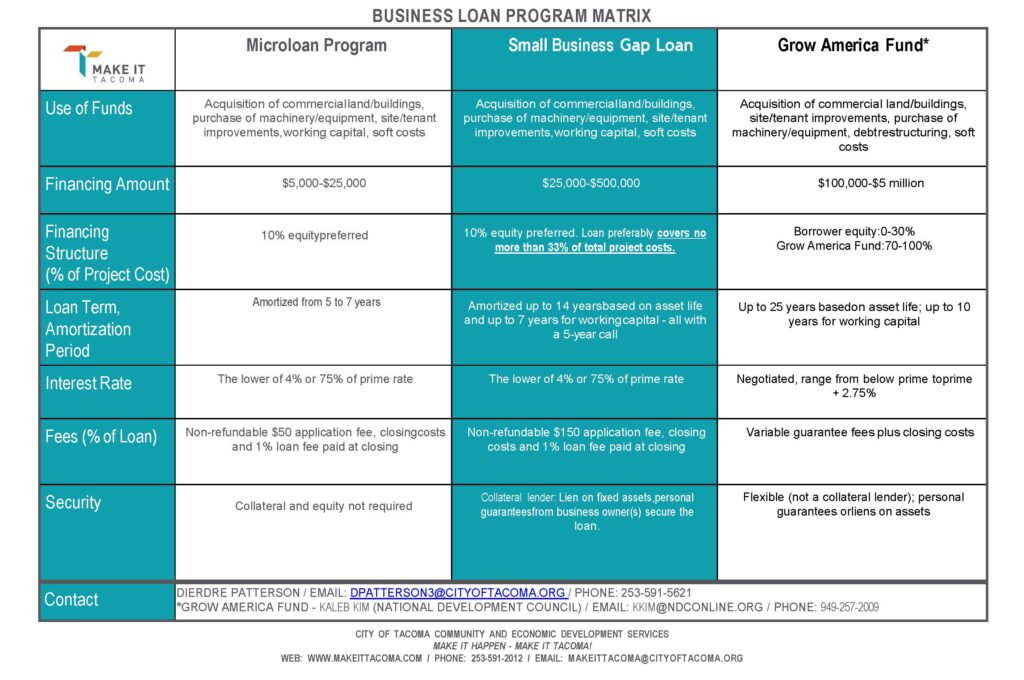

Our Microloan Program provides small, short-term loans to startups and small businesses that may not qualify for traditional bank financing.

Key features of the Microloan Program include:

- Loan amounts ranging from $5,000-$25,000

- 5-to-7-year term

- Interest rate of 4% or 75% of the prime rate, whichever is lower

- Collateral and equity are not required

Eligibility Criteria:

- Must be a startup or existing small business located within Tacoma city limits

-

Our Small Business Loan program offers gap financing for businesses looking to expand operations, purchase equipment, or increase inventory.

Key features of the Small Business Loan

- Loan amounts up to $500,000 (City of Tacoma funds cannot represent more than 33% of the total funds)

- Flexible repayment terms tailored to your business’s cash flow

- Interest rates of 4% or 75% of the prime rate, whichever is lower

- Collateral required; terms vary depending on loan amount

- Equity contribution required; terms vary depending on loan amount

Eligibility Criteria

- Established small business operating within Tacoma city limits

-

Interested in a loan but not sure which would be the best fit? Check out the business loan matrix to see which loan would be the best fit for your business needs.

-

Grow America Fund

We collaborate with the Grow America Fund to provide access to additional capital for eligible businesses. Visit Grow America Fund for more information on their funding options and eligibility criteria.

Craft3

Craft3, a non-profit Community Development Financial Institution (CDFI) serving the Pacific Northwest, provides a diverse range of financing solutions tailored to meet the unique needs of small businesses. Craft3 prioritizes businesses that contribute to community resilience and economic growth. Visit Craft3 to learn more about their financing options and eligibility criteria.

Business Impact Northwest

Business Impact Northwest is a non-profit organization dedicated to empowering entrepreneurs and small businesses in the Pacific Northwest. Their mission is to provide access to capital, comprehensive business support, and community resources to help businesses thrive. Visit Business Impact Northwest to learn more about their funding options and eligibility criteria.