Employee Benefits

The City of Tacoma has adopted a total rewards compensation philosophy, which strives to have a rewarding employment experience. Our rewards package includes compensation, benefits, work-life effectiveness, recognition, performance management, and talent development. The City offers competitive and comprehensive benefit offerings for our employees and their eligible family members.

Benefits and Plan Information

Our Employee Benefits Guide is designed to provide an overview and general information about the benefit options available at the City (e.g., health plans, life and disability, time off programs, retirement plans, and Wellness program). For more detailed information on the City’s benefit offerings, please review the Benefit Plan Information section below and/or collective bargaining agreement (if applicable). Visit our quick links below for other important information, benefit forms, and resources.

-

The majority of forms an employee may need to access related to their City of Tacoma benefits are listed below in certain categories and by the benefit plan.

Submission of Benefit Forms

All forms should be submitted to the Benefits Office, unless otherwise noted, via interoffice mail, USPS mail, or by scanning the form and submitting it via email to benefits@tacoma.gov, or fax (253) 591-5873. For questions, please contact the Benefits Office at (253) 573-2345 or benefits@tacoma.gov.

New Enrollment & Mid-Year Qualifying Life Events

City of Tacoma Health and Welfare Benefit Plan Forms

Deferred Compensation 457(b) Plan

MissionSquare Retirement

- MissionSquare Retirement Asset Roll In/Transfer

- Co-Provider Retirement Transfer to MissionSquare (From Nationwide Only)

- Rollover out of MissionSquare Retirement

- MissionSquare Retirement Emergency Withdrawal Packet

- MissionSquare Retirement Pre-Retirement Catch-Up – Please contact the Benefits Office

Nationwide (Tacoma Fire Only)

- Nationwide Outgoing Rollover Request

- Nationwide Incoming Assets Form

- Nationwide Pre-Retirement Catch-Up – Please contact the Benefits Office

Flexible Spending (FSA) Plan

- FSA Authorization for Direct Deposit – Submit Directly to Trusteed Plan Services

- FSA Letter of Medical Necessity – Submit Directly to Trusteed Plan Services

- FSA Change in Election Form – Please contact the Benefits office for assistance

- FSA Reimbursement Request – Submit Directly to Trusteed Plan Services

Life and Disability Plans Forms

- Medical History Statement Application – (For Supplemental, Spouse, and Dependent Life Insurance or Supplemental Long-term Disability Insurance)

Note: To be completed if applying for life insurance for employee or spouse life above the guarantee issue limits available when initially becoming eligible. To apply for coverage or when applying for coverage at a later date for all life insurance products and supplemental long-term disability insurance. Please complete and send to benefits@tacoma.gov, we will in turn, submit this electronically on your behalf. Please contact the Benefits office with any questions.

- Life Insurance Claim – Please contact the Benefits Office

- Disability Insurance Claim – Please contact the Benefits Office

Medical Plans

Related information can be found on the Plan Information web page.

Kaiser Permanente

- Kaiser Permanente Mail Order New Prescription Form

- Kaiser Permanente Mail Order Prescription Refill Form

- Kaiser Permanente Mail Order Prescription Transfer Refill Form

Regence

Retirement Plans

Follow these links to obtain information for the applicable pension plan:

- Tacoma Employees’ Retirement System (TERS) Retirement Forms – City of Tacoma Retirement Office

- Police/Fire Retirement Pension/Beneficiary Forms – State of Washington (DRS)

- Railroad Retirement Board – Tacoma Rail Only

Resources and General Information

-

Employees log-on to the Employee Self Service (ESS) web portal to initially enroll in their City benefits and also during the annual Open Enrollment period. Additionally, they can update family member and dependent information, contact information, beneficiaries, as well as perform other changes related to their W-4 tax withholdings, enter time for the pay period, etc.

To maintain the security of personal employee information, Employee Self Service (ESS) must be accessed on either a computer connected to the City network, or via VPN using the Rapid Identity application. Requests for VPN access to ESS must be submitted by a T-Ticket to the IT Department or requested by phone at (253) 591-2057.

How to Change Your Information in Employee Self-Service (ESS)

- How to Change Dependent Social Security Numbers in ESS

- How to Change Your Life Insurance Beneficiaries in ESS

- How to Change Your Address in ESS

- Who to Contact to Change your Beneficiaries

Where Do I Review City Benefits Plan Information

For a high-level summary of the City’s benefit offerings, see the Employee Benefits Guide. For more details on benefit plan offerings can be found in the summaries and plan documents/booklets information on the Benefit Plan Information web page.

Where to Find Additional Plan Resources and Offerings

Many of the City’s benefit plans and carriers offer additional services, discounted benefit options, and tools/resources for employees and their eligible family members. This information can be found on the Benefit Plan Information page under each benefit plan and additionally can be found by visiting the benefit carrier website.

Where to Submit Benefits Forms and other related documents

Forms and documents associated with the City of Tacoma’s employee benefit plans should be sent to the Benefits Office as listed below:

- Scan/email to benefits@tacoma.gov

- Mail to: City of Tacoma, Human Resources Department, Attention: Benefits Office, 747 Market Street, Room 1420, Tacoma, WA 98402

- Interoffice mail to Human Resources Department/Benefits Office TMB 1420

- Fax to (253) 591-5873

Who to Contact with Questions or Issues Related to City of Tacoma Benefits

Contact the Benefits Office at (253) 573-2345 or via email at benefits@tacoma.gov.

-

The following dependents are eligible for coverage on City of Tacoma benefit plans. When an employee requests to enroll a new dependent on their plan(s) you will be required to provide a dependent eligibility form and supporting documentation. Please review the Dependent Verification Form to identify required documentation and timelines for submitting the documentation.

- Your legal spouse

- Your domestic partner (same sex or opposite sex) as defined in RCW 26.60

- Your, your spouse’s, or domestic partner’s natural child, adopted child, stepchild, or child legally placed with you or your spouse or domestic partner for adoption under the age of 26

- A child for whom you or your spouse or domestic partner have court‑appointed legal guardianship

- Your, your spouse’s, or domestic partner’s otherwise eligible child who is over the age of 26 and the affidavit of dependent eligibility form to your Plan Administrator and it has been approved by the Plan Administrator has been submitted and approved.

- Your, your spouse’s or your domestic partner’s otherwise eligible child who is age 26 or over and incapable of self-support because of physical, mental or developmental disability that prevents the child from establishing or maintaining consistent employment or independence that began before their 26th birthday, if you complete and submit the affidavit of dependent eligibility form, with written evidence of the child’s incapacity, within 31 days of the later of the child’s 26th birthday or your effective date and either:

- They are a dependent immediately before their 26th birthday; or

- Their 26th birthday preceded your effective date and he or she has been continuously covered as your dependent on group, individual, or other insurance plan (including public programs) coverage since that birthday.

- Newly hired employees wishing to enroll an eligible dependent must also be able to demonstrate that the dependent child has been covered on a group, individual, or other insurance plan (including public programs) immediately prior to enrollment on this plan.

-

After initial enrollment for City of Tacoma benefits, employees are able to make changes to their benefit elections and covered eligible dependents during the annual Open Enrollment period. The only other time changes can be made to benefit coverage is if an employee experiences a qualifying life event, such as marriage, birth of a child, divorce, etc. These qualifying life events provide the opportunity for a mid-year special enrollment opportunity.

Dependent changes must be submitted within the established timelines and be consistent with the type of qualifying event an employee has experienced. Failing to do so may result in an employee having to wait until the following Open Enrollment period in late Fall to make changes to their benefit coverage for the next calendar year.

If an employee experiences a qualifying life event, they should contact the Benefits Office as soon as possible so that we can assist them in completing and submitting the proper documentation within the required deadlines. We can be reached via telephone at (253) 573-2345 or email at benefits@tacoma.gov.

-

Visit the Qualifying Life Events document and Dependent Eligibility Form to obtain the information needed to request changes to City benefits and learn about other allowed changes due to a qualifying life event (e.g., contact information, beneficiary information, other benefit coverage to elect and/or change). Consider as well, other places you may need to change and/or update your beneficiaries and contact information by reviewing the Beneficiary Resources Guide.

Event Type Reason for Change Deadline to Remove Dependents from Coverage Dropping Coverage Obtained Other Coverage Within 30 days of obtaining other coverage Dropping Coverage Divorce/Legal Separation Within 30 days of the divorce or legal separation Dropping Coverage Dissolution of Domestic Partnership Within 30 days of the dissolution of the domestic partnership Dropping Coverage Death of a Dependent Within 30 days of the death Adding Coverage Marriage Within 30 days of marriage Adding Coverage Domestic Partner Within 30 days of establishing Domestic Partnership with a State of Washington

domestic partner registration in line with RCW 26.60.030Adding Coverage Birth Within 60 days of birth Adding Coverage Adoption Within 60 days of adoption or placement for adoption Adding Coverage Legal Custody Within 60 days of court-appointed legal guardianship Adding Coverage Loss of Coverage Within 30 days of the loss of coverage, OR 60 days from involuntary loss of

coverage under Medicaid or the Children’s Health Insurance Program (CHIP) -

The City of Tacoma is required by law to share and post benefits related notices and regulatory information. Please take a minute to review the notices below.

Your 1095-C Tax Document

Please click here for information on your 1095-C tax document and what you need to know when filing your taxes.

Rights & Protections Against Surprise Medical Bills

When you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center, you are protected from surprise billing or balance billing. Please click here for more information.

Women’s Health and Cancer Rights Act of 1998

Did you know that your medical plan, as required by the Women’s Health and Cancer Rights Act of 1998, provides benefits for mastectomy related services? These services include:

- Reconstruction and surgery to achieve symmetry between the breasts

- Prostheses

- Complications resulting from a mastectomy (including lymphedema)

Please refer to your medical plan Summary Plan Description for details or contact your Plan Administrator for more information.

Newborn Act

Did you know that your medical plan, as required by the Newborns’ and Mothers’ Health Protection Act, generally may not restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child? Length of stay may be up to 48 hours following a vaginal delivery or up to 96 hours following a delivery by cesarean section as subject to the attending providers’ discharge.

However, Federal law generally does not prohibit the mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under Federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours).

Please refer to your medical plan Summary Plan Description for details, or contact your Plan Administrator for more information. Please be aware that in order to add a newborn dependent to the plan, you need to submit your enrollment change application to Human Resources in a timely manner. This is usually within 31 days of the event.

Special Enrollment Rights

Did you know that if your family experiences a qualified change in family status, that you and/or your dependents can enroll in the group insurance plans? Qualified changes include:

- Marriage, birth, adoption of a child, or placement for adoption

- A loss of coverage under another group plan (i.e., your spouse’s employer medical plan)

Please refer to your medical plan Summary Plan Description for details, or contact your Plan Administrator for more information. Please be aware that in the event of a qualified change in family status, you need to submit your enrollment change application to Human Resources in a timely manner. This is usually within 31 days of the event.

If you are declining enrollment for yourself or your dependents (including your spouse) because of other health insurance or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage).

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you are eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage. These states use funds from their Medicaid or CHIP programs to help people who are eligible for these programs, but also have access to health insurance through their employer. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a state listed here, you can contact your state’s Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, you can contact your State Medicaid or CHIP office or call 877-543-7669 or visit the Insure Kids Now website to find out how to apply. If you qualify, you can ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

Once it is determined that you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligibility under your employer plan, your employer must permit you to enroll in your employer plan if you are not already enrolled. This is called a special enrollment opportunity and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, you can visit the Department of Labor website or call them toll-free at 866-444-3272.

Contact the State for further information on eligibility:

- Washington – Medicaid: 800-562-3022

- Apply for Medicaid at the Washington Medicaid website

Additional Information on Special Enrollment Rights

Medicare Prescription Drug Coverage (Medicare Part D)

Did you know that your prescription drug coverage offered under the Regence and Kaiser Permanente plans is, on average for all participants, expected to pay out as much as the Standard Medicare drug plan. This is known as creditable coverage.

Medicare Part D and your Prescription Drug Coverage

Notices from Employers Offering Wellness Programs

In compliance with the Americans with Disabilities Act (ADA) rule and the Equal Employment Opportunity Commission (EEOC) reporting requirement, the City of Tacoma provides this annual notice. The ADA rule requires employee wellness programs which ask employees about their medical conditions or to complete medical examinations (such as tests to detect high blood pressure, high cholesterol or diabetes) to ensure that these programs are reasonably designed to promote health and prevent disease, are voluntary, and ensure employee medical information is kept confidential.

Transparency in Coverage (TIC): Link to Machine-Readable Files

The Federal Transparency in Coverage Final Rules, require certain group health plans to disclose on a public website information regarding in-network provider rates and historical out-of-network allowed amounts and billed amounts for covered items and services in two separate machine-readable files (MRFs). The machine-readable files are formatted to allow researchers, regulators, and application developers to access and analyze data more easily. The MRFs for the City of Tacoma’s health benefit plans are found by clicking this link hosted on the Regence BlueShield website. Search using the City of Tacoma’s Employer Identification Number (EIN): 91-6001283.

-

The City of Tacoma provides its employees with a voluntary deferred compensation program, which allows employees to supplement their normal retirement income with a savings plan that is authorized under Section 457 of the IRS Code. The City of Tacoma’s Deferred Compensation Committee oversees this plan offering. Visit the Deferred Compensation Section of the Plan Information page for information related to the Committee as well as general deferred compensation information.

-

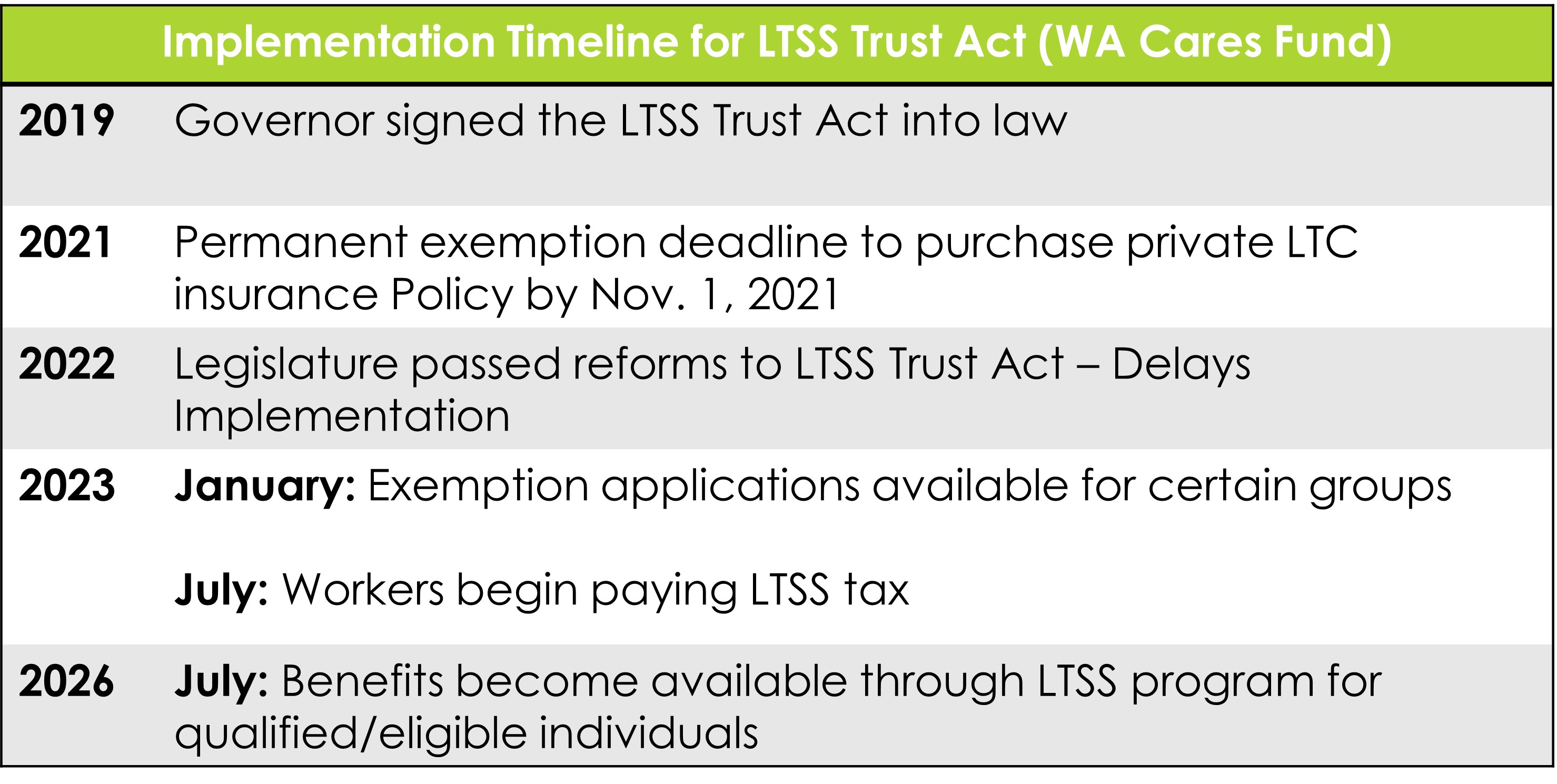

This web page pertains to City of Tacoma General Government and Tacoma Public Utility employees only. Community members seeking information on this program should visit WA Cares Fund Website.

WA Cares Fund Overview

The WA Cares Fund is a mandatory long-term care insurance benefit established by Washington state law (Long-Term Services and Supports Trust Act) in 2019. The WA Cares Fund will be supported by a premium paid by employees only. Starting July 2026, these benefits may be used for a range of services, including professional care at home or at a licensed facility; training, pay and support for family members who provide care; memory care; home-delivered meals; rides to a health care provider; adaptive equipment and technology; home safety evaluation; and emergency alert devices.

View Long Term Care FAQsWA Cares Mandatory Employee Payroll Deductions Begin for Paychecks on or After July 1, 2023

For City of Tacoma employees who have not opted out of the program, the first paycheck which included the long-term care tax was paid on July 7, 2023, which included wages earned from June 19 – July 2, 2023.

The premium has been set by state law at 0.58% of gross wages, or $0.58 per $100. For example, if an employee earns $50,000 annually, the total annual premium is $290, while an employee earning $150,000 would contribute $870 annually. Unlike other payroll taxes, there is no cap on the wages subject to this tax.

WA Cares Benefit Amount

Beginning in July 2026, eligible individuals who have vested in the program and have a need for long-term services and supports may begin applying for benefits. If eligible, and if the Department of Social and Health Services (DSHS) determines that an individual requires assistance with activities of daily living, the program provides benefits up to a maximum lifetime benefit of $36,500 with no daily limit (adjusted annually for inflation). Individuals born before January 1, 1968, can earn a partial benefit of 10% of the full benefit amount for each year they worked at least 500 hours.

WA Cares Program Eligibility

In order to be eligible for WA Cares Fund for full benefits, an individual must have worked and contributed to the fund for:

- A total of 10 years without an interruption of five or more consecutive years; or

- Three of the last six years at the time you apply for the WA Cares Fund benefit; and

- Worked at least 500 hours per year.

In order to be eligible for WA Cares Fund partial benefits, an individual must have been born before January 1, 1968 and worked and contributed to the fund for at least one year for 500 hours.

Additionally, to be eligible for benefits an individual must be at least 18 years old and a current resident of Washington.

Exemption Options for the WA Cares Program

Private Insurance Exemption

Individuals who had private long-term care insurance on or before November 1, 2021, were able to apply for an exemption from the WA Cares Fund from October 1, 2021, until December 31, 2022. This opt-out provision is no longer available. (See below for limited new exemption options available January 1, 2023.)

Note: Any exemption approved by the State for the private insurance exemption is permanent, and individuals may never opt back into the State program under the current legislation.

New Exemption Options Available as of January 1, 2023

Certain workers who would unlikely qualify or use their benefits can request an exemption beginning on January 1, 2023, and will be ongoing:

- Workers who live out of state, workers on non-immigrant visas, and military spouses or registered domestic partners can be granted a conditional exemption*

- Veterans with a 70% or higher service-connected disability can choose to permanently opt out of the program

To opt out of the State’s long-term care program, individuals must apply for an exemption through the Employment Security Department (ESD) website wacaresfund.wa.gov. Visit the “Exemptions” section of the website and complete an Exemption Application. Individuals will need to verify their identity and establish a SecureAccess Washington (SAW) account. Individuals will also need to provide certain documentation to ESD when applying for an exemption based on the type of exemption they are applying for, which can be found here.

*Note: Workers with these exemptions will begin contributing to the State program if their situation changes and they no longer qualify for an exemption. They are required to notify their employer and ESD within 90 days of no longer qualifying. A discontinued exemption will take effect the quarter immediately following notification and premiums will be assessed. Employees who fail to provide notification will owe any unpaid premiums to ESD. Unpaid premiums will be assessed interest of one percent, compounded monthly, until payment is made in full.

Employee Notification Requirement

An employee who obtains an approved exemption from the ESD is required to provide written notification to all current and future employers of the exemption. ESD does not notify the City of your premium exemption. City employees must submit the exemption approval letter received from ESD to the City’s Benefits Office via email at benefits@tacoma.gov. If an employee fails to provide written notification of an approved, effective exemption to the Benefits Office, the City must collect and remit premiums to ESD. -

City employees can find resources for the following on the City’s internal SharePoint site by navigating to Human Resources > Compensation and Benefits. For questions or assistance, contact the Disability & Leave Management Office at (253) 591-5452 or DLM@tacoma.gov

- Mandatory Paid Sick Leave (MPSL)

- Paid Family and Medical Leave (PFML)

- Family and Medical Leave Act (FMLA)

- Shared Leave

- Reasonable Accommodations